Colonial Currency, Georgia, $4, 1776

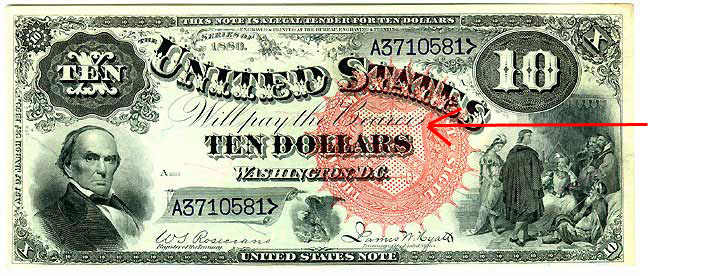

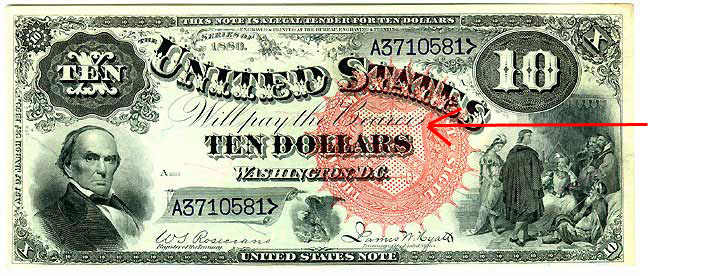

Legal Tender Note, $10, 1880

National Bank Note, First National Bank of Seattle, Washington, $50, 1902

Colonial Currency, Georgia, $4, 1776 |

|

Legal Tender Note, $10, 1880 |

|

National Bank Note, First National Bank of Seattle, Washington, $50, 1902 |

|

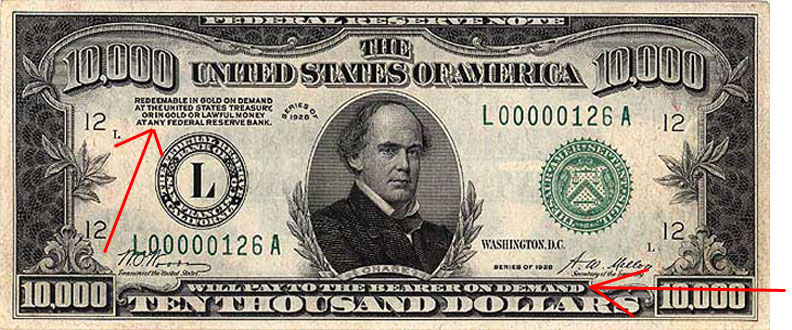

Federal Reserve Note, 1928 |

|

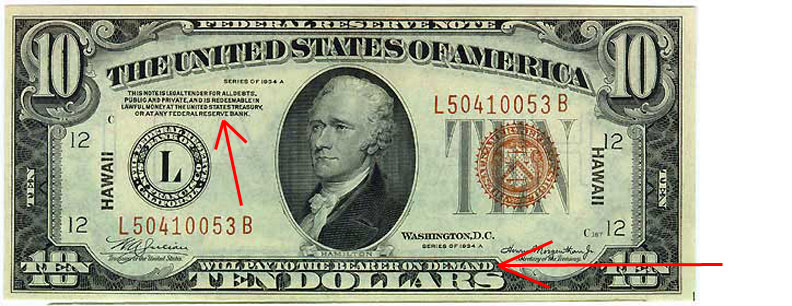

Federal Reserve Note, 1934 |

|

Federal Reserve Note, 1941 |

|